250 cc engine

250 cc

4 Stroke, 4 Valve, Single Cylinder Liquid Cooled, DOHC

25 nm

@7250 RPM

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

20.7 nm

@7250 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

124.7 cc

Air Cooled, 4-Stroke, OHC, Single Cylinder

10.6 nm

@6000 RPM

124.7 cc

Air Cooled 4 stroke

10.6 nm

@6000 RPM

163.2 cc

Air oil cooled, 4-stroke, Single cylinder, OHC

14.6 nm

@6500 RPM

199.6 cc

Oil Cooled, 4 stroke 4 Valve single cylinder OHC

17.35 nm

@6500 RPM

250 cc engine

210 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

97.2 cc engine

125 cc engine

125 cc engine

125 cc engine

124.7 cc engine

124.7 cc engine

163.2 cc engine

163.2 cc engine

199.6 cc engine

210 cc engine

440 cc engine

440 cc engine

250 cc

4 Stroke, 4 Valve, Single Cylinder Liquid Cooled, DOHC

25 nm

@7250 RPM

210 cc

4 Stroke 4 Valve Single Cylinder Liquid Cooled DOHC

20.7 nm

@7250 RPM

97.2 cc

Air cooled, 4 stroke

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

97.2 cc

Air cooled, 4-stroke, Single cylinder, OHC

8.05 nm

@6000 RPM

125 cc

Air cooled, 4-Stroke

10.5 nm

@6500 RPM

125 cc

5.9 sec, Acceleartion 0-60kmph

10.5 nm

@6500 RPM

125 cc

Air cooled, 4-stroke, Single cylinder, OHC

10.6 nm

@6000 RPM

124.7 cc

Air Cooled, 4-Stroke, OHC, Single Cylinder

10.6 nm

@6000 RPM

124.7 cc

Air Cooled 4 stroke

10.6 nm

@6000 RPM

163.2 cc

Air oil cooled, 4-stroke, Single cylinder, OHC

14.6 nm

@6500 RPM

163.2 cc

Air Cooled 4 stroke

14 nm

@6500 RPM

199.6 cc

Oil Cooled, 4 stroke 4 Valve single cylinder OHC

17.35 nm

@6500 RPM

210 cc

Liquid cooled, 4-stroke, Single cylinder, OHC

20.4 nm

@4000 RPM

440 cc

Oil cooled, 4-stroke, Single cylinder, OHC

36 nm

@4000 RPM

440 cc

Air cooled, 4-stroke, Single cylinder, OHC

38 nm

@4000 RPM

156 cc engine

124.6 cc engine

125 cc engine

124.6 cc engine

110.9 cc engine

110.9 cc engine

156 cc

Liquid cooled, 4 Valve single cylinder SOHC

14 nm

@6500 RPM

124.6 cc

Air Cooled, 4 stroke, SI

10.4 nm

@6000 RPM

125 cc

Air cooled, 4 stroke, SI engine

10.4 nm

@5500 RPM

124.6 cc

Air Cooled, 4-Stroke, SI Engine

10.36 nm

@5500 RPM

110.9 cc

Air cooled, 4-stroke, SI engine

8.70 nm

@5750 RPM

110.9 cc

Air cooled, 4-stroke Single Cylinder OHC

8.70 nm

@5500 RPM

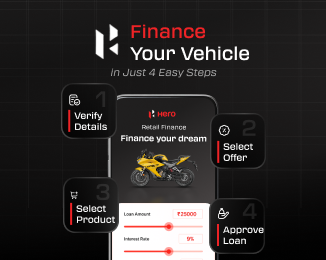

Get a Provisional Sanction for your vehicle in just few clicks

Finance Partner

- Are the offers competitive compared to other online marketplaces?

- Who can apply for loan on eFinance?

- How many financers are on-boarded to eFinance currently and what is the plan to onboard other financers?

- How is eFinance beneficial to the customer as compared to the current process of physical financing?

- Can I complete the entire Financer Journey through eFinance or I need to do some processes offline also?

- Can the sanction letter generated through eFinance be used to get the delivering the vehicle from the dealership?

- The sanction letter issued by eFinance is valid for how many days?

- Is KYC part of eFinance process or it has to be done offline and who is responsible for completing the same?

- Can the sanction terms like amount and rate as received through eFinance, change after physical KYC?

- Is my personal information and financial data provided on the portal safe?

- What is the time taken under eFinance process for getting sanction for a customer?

- Will the customer get any communication from eFinance or the financers upon sanction or rejection of the loan?

- Do I have to pay the downpayment of my loan before sanction?

- Can the customer apply for multiple offers on eFinance from different financers simultaneously?

- What happens if a customer is rejected by all financers available on eFinance?

Unlock Best Loan Offer

This document sets out the terms and conditions for access or usage of HERO’s website at www.heromotocorp.com (“Website”) and/ or software application of HERO used by its authorised dealers inter alia for providing assistance to the customers in relation to the Platform Services (“Application”) (together referred to as “Platform”) and services provided therein, and is published in accordance with the provisions of Information Technology Act, 2000 (as amended), rules made thereunder (including Rule 3 of the Information Technology [Intermediary Guidelines and Digital Media Ethics Code] Rules, 2021) and other applicable laws that require publishing the rules and regulations, Privacy Policy and Terms of Use of the Platform. For ease of reference, this document is divided into two parts, (i) Part A containing the general terms of use applicable to the Platform as whole; and (ii) Part B which contains the terms and conditions specifically applicable for Platform Services (defined under Part B, and also referred to as the “Services”) provided on the Platform. With respect to the Platform Services, Part B shall apply along with Part A of these Terms of Use.

This document/agreement is an electronic record in terms of Information Technology Act, 2000 and generated by a computer system and does not require any physical or digital signatures.

PART A - GENERAL TERMS OF USE

These Terms of Use along with Privacy Policy and Disclaimer are a legally binding document between You and Us and lays out the terms, conditions and rules, as may be amended and supplemented, from time to time which shall be applicable to Your present and future access and use of the Platform and availing/ applying for/ use of Services on the Platform.

This user agreement (“Terms and Conditions” or “Terms of Use” or “T&C” or “Terms” or “Agreement”) is between You (“You” or “Your” or “End User” or “User” or “Registered User”) and Hero MotoCorp Limited (“Company” or “Us” or “We” or “Our” or “HERO”). By accessing this Platform or providing Your information on the Platform, You agree to be bound by these Terms of Use. This Agreement along with Privacy Policy and Disclaimer describes Our relationship with You.

Notwithstanding anything contained or said in any other document, if there is a conflict between the terms mentioned herein below and any other document, the terms contained in the present Terms of Use shall alone prevail for the purposes of usage of the Platform. We reserve the right, at Our sole discretion, to change, modify, add or remove portions of these Terms of Use, Privacy Policy, at any time without any prior written notice to You. For this reason, We encourage You to review these Terms of Use every time You visit or use Our Platform/ Services.

1. INTRODUCTION

The domain name www.heromotocorp.com is owned, maintained and operated by Hero MotoCorp Limited.

2. ELIGIBILITY OF USER

Usage/browsing on the Platform is free for visitors. HERO does not charge any fee for browsing the Platform.

Use of this Platform, is allowed only to persons who can form a legally binding contract under the Indian Contract Act, 1872. If You are a minor i.e., under the age of 18 years, You are not eligible to use the Platform and may only use the Platform with the involvement of a parent or guardian.

HERO reserves the right to terminate Your login, if any and / or refuse to provide You with access to the Platform if it is brought to HERO’s notice or if it is discovered that You are under the age of 18 years and/or violate any provision of the Terms of Use.

3. USER RESPONSIBILITY AND REGISTRATION OBLIGATIONS

a. We reserve the right to terminate Your login account, if any and/or refuse to provide You with access to the Platform or the Services, if it is brought to Our notice that User is not an eligible user or for any other reason at HERO’s discretion. By providing information on the Platform, You agree that such information will be true, accurate, current and complete and You will keep all the information up to date. You agree that if You provide any information that is untrue, inaccurate, not current or incomplete or We have reasonable grounds to suspect that such information is untrue, inaccurate, not current, incomplete or not in accordance with these Terms of Use, We shall have the right to indefinitely suspend or terminate or block access of Your user account on the Platform and refuse to provide You with access/use to/of the Platform or the Services.

If You or HERO terminates Your use of the Platform or any service therein, HERO may delete any content or other materials relating to Your use of the Platform and will have no liability to You or any third party for doing so. In case You have created a login for the Platform, You are solely responsible for maintaining the confidentiality of Your user ID/Your account/display name and password and for restricting access to Your computer or any other device used to access the Platform to prevent unauthorized access to Your account and should inform Us immediately if You have any reason to believe that Your password has become known to anyone else, or if the password is being, or is likely to be, used in an unauthorized manner. You agree to accept responsibility for all activities that occur under Your account and password. User can also deregister and delete account from the Platform with or without cause /reason.

b. HERO shall have the right to retain information provided by You for such period as prescribed under applicable laws.

c. Use of the Platform:

You agree, undertake and confirm that Your use of Platform shall be strictly governed by the following binding principles:

(i) You shall not host, display, upload, modify, publish, transmit, update or share any information which:

· belongs to another person and to which You do not have any right to use;

· is grossly harmful, harassing, blasphemous, defamatory, obscene, pornographic, paedophilic or menacing, libellous, invasive of another’s privacy including bodily privacy, insulting, or harassing on the basis of gender, hateful, racially or ethnically objectionable, disparaging, relating to or encouraging money laundering or gambling or an online game that causes user harm, or promoting enmity between different groups on the grounds of religion or caste with the intent to incite violence, otherwise unlawful in any manner whatever; or unlawfully threatening or unlawfully harassing including but not limited to “indecent representation of women” within the meaning of the Indecent Representation of Women (Prohibition) Act, 1986;

· is misleading in any way;

· is harmful to child;

· is patently offensive to the online community, such as sexually explicit content, or content that promotes obscenity, paedophilia, racism, bigotry, hatred or physical harm of any kind against any group or individual;

· harasses or advocates harassment of another person;

· involves the transmission of “junk mail”, “chain letters”, or unsolicited mass mailing or “spamming”;

· promotes illegal activities or conduct that is abusive, threatening, obscene, defamatory or libellous;

· infringes upon or violates any third party’s rights including, but not limited to, intellectual property rights, rights of privacy (including without limitation unauthorized disclosure of a person’s name, email address, physical address or phone number) or rights of publicity;

· promotes an illegal or unauthorized copy of another person’s copyrighted work (see “Intellectual Property Right Complaints” below for instructions on how to lodge a complaint about uploaded copyrighted material), such as providing pirated computer programs or links.

· contains restricted or password-only access pages, or hidden pages or images (those not linked to or from another accessible page);

· provides material that exploits people in a sexual, violent or otherwise inappropriate manner or solicits personal information from anyone;

· provides instructional information about illegal activities, violating someone’s privacy, or providing or creating computer viruses;

· contains video, photographs, or images of another person;

· tries to gain unauthorized access or exceeds the scope of authorized access to the Platform or to profiles, blogs, account information, bulletins, or other areas of the Platform or solicits passwords or personal identifying information for commercial or unlawful purposes from other users;

· interferes with another user’s use and enjoyment of the Platform or any other individual’s user and enjoyment of similar services;

· refers to any Platform or URL that, in our sole discretion, contains material that is inappropriate for the Platform or any other Platform, contains content that would be prohibited or violates the letter or spirit of these Terms of Use;

· harm minors in any way;

· infringes any patent, trademark, copyright, trade secret or other proprietary rights of HERO or any third party;

· violates any law for the time being in force;

· deceives or misleads the addressee/ users about the origin of such messages or knowingly and intentionally communicates any misinformation or information which is grossly offensive or menacing in nature, or patently false and untrue or misleading in nature;

· impersonate another person;

· contains software viruses or any other computer code, files or programs designed to interrupt, destroy or limit the functionality of any computer resource; or contains any trojan horses, worms, time bombs, cancel bots, easter eggs or any other computer programming routines that may damage, detrimentally interfere with, diminish value of, surreptitiously intercept or expropriate any system, data or personal information;

· threatens the unity, integrity, defence, security or sovereignty of India, friendly relations with foreign states, or public order or causes incitement to the commission of any cognizable offence or prevents investigation of any offence or is insulting any other nation;

· shall not be false, inaccurate or misleading;

· shall not, directly or indirectly, offer, attempt to offer, trade or attempt to trade in any item, the dealing of which is prohibited or restricted in any manner under the provisions of any applicable law, rule, regulation or guideline for the time being in force;

· is in the nature of an online game that is not verified as a permissible online game;

· is in the nature of advertisement or surrogate advertisement or promotion of an online game that is not a permissible online game, or of any online gaming intermediary offering such an online game;

· shall not create liability for Us or cause Us to lose (in whole or in part) the services of Our internet service provider (“ISPs”) or other suppliers;

(ii) If You believe that any content on the Platform is affected due to above points, You shall immediately notify Us in writing. HERO will make all reasonable endeavours to remove such content complained about within a reasonable time.

(iii) Any non-compliance of use of Platform would be dealt as per the policy. For any non-compliance with these Terms, rules and regulations, Privacy Policy for access or usage of the Platform/ computer resource of HERO, HERO shall have the right to terminate Your access or usage rights immediately or remove non-compliant information or both, as the case may be.

d. You accept and agree that You shall utilize the services offered by HERO on the Platform for Your own personal use alone. You shall neither attempt to make any commercial/ business use of the services, nor shall You use the services on behalf of anybody else.

e. You agree and acknowledge that for undertaking any financial transaction through the Platform, HERO may undertake client/customer due diligence measures and seek mandatory information required for KYC purpose which as a customer, You are obliged to give, in accordance with applicable Prevention of Money Laundering Act (“PMLA”) and rules. HERO may obtain sufficient information to establish, to its satisfaction, the identity of each new User, and to ascertain the purpose of the intended nature of relationship between You and the relevant financial institution financing the transaction. You agree and acknowledge that HERO can undertake enhanced due diligence measures (including any documentation), to satisfy itself relating to customer due diligence requirements in line with the requirements and obligations under the applicable PMLA Act and rules.

f. This Platform may provide links to other websites or resources. Since HERO has no control over such third party websites and resources, You acknowledge and agree that HERO is not responsible for the availability of such external sites or resources, and does not endorse and is not responsible or liable for any content, advertising, products or other materials on or available from such sites or resources. You further acknowledge and agree that HERO shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any such content, goods or services available on or through any such site or resource. Your interaction with any third party accessed through the Platform is at Your own risk, and HERO will have no liability with respect to the acts, omissions, errors, representations, warranties, breaches or negligence of any such third parties or for any personal injuries, death, property damage, or other damages or expenses resulting from Your interactions with the third parties.

4. PRIVACY

We view protection of Your privacy as a very important principle. We clearly understand that You and Your Personal Information is one of Our most important assets. Privacy Policy applicable on this Platform is available at Privacy Policy. If You object to Our current Privacy Policy and Your information being transferred or used in the way described in Privacy Policy, please do not use the Platform.

5. ELECTRONIC COMMUNICATIONS

When You visit the Platform or send e-mails to Us, You are communicating with Us electronically. We may communicate with You by e-mail, SMS, phone call, by posting notices on the Platform or by any other mode of communication. For contractual purposes, You consent to receive communications (including transactional, promotional and/or commercial messages) from Us with respect to Your use of the Platform.

6. INTELLECTUAL PROPERTY RIGHTS/ TRADEMARK, COPYRIGHT AND RESTRICTION

All content included on the Platform, such as text, graphics, logos, button icons, images, audio clips, digital downloads, data compilations, and software, is the property of HERO and/or, its affiliates or its content suppliers and is protected under trademark and copyright laws and other relevant law(s) as applicable from time to time.

You shall not extract or re-utilise parts of the contents of the Platform without the consent of HERO and / or its affiliates (as may be applicable). In particular, You shall not utilise any data mining, robots, or similar data gathering and extraction tools to extract (whether once or many times) for re-utilisation of any parts of this Platform. You shall also not create and/ or publish Your own database that features any / or substantial (eg: prices and product listings, etc.) parts of this Platform.

Platform or any portion thereof (including but not limited to any copyrighted material, trademarks, or other proprietary information) may not be reproduced, duplicated, copied, sold, resold, visited, distributed or otherwise exploited for any commercial purpose without Our express written consent.

7. INTELLECTUAL PROPERTY RIGHTS COMPLAINTS

HERO respects the intellectual property of others. If You believe that Your work has been copied in a way that constitutes any Intellectual Property Right infringement, please address a complaint to the Grievance Officer whose contact details are mentioned at the end of this Part of the Terms of Use.

8. PRODUCT COMPLIANCE

Products displayed on the Platform are manufactured/ procured as per the applicable local laws of India and are in conformity with the required Indian industry standards.

9. WARRANTIES & LIABILITY

a. All information, content, materials, products (including software) and other services included on or otherwise made available to You by HERO on the Platform are provided on an AS IS and AS AVAILABLE basis, unless otherwise specified in writing. You expressly agree that Your use of the Platform is at Your sole risk.

b. HERO does not warrant that this Platform will be uninterrupted, error free, or constantly available, or available at all or that any information on this Platform is complete, true or accurate. Further, HERO shall not be held responsible for non-availability of the Platform during periodic maintenance operations or any unplanned suspension of access to the Platform that may occur due to technical reasons or for any reason beyond HERO’s control. You understand and agree that any material and/or data downloaded or otherwise obtained through the Platform is done entirely at Your own discretion and risk and You shall be solely responsible for any damage to Your computer systems or loss of data that results from the download of such material and/or data.

c. We shall not be liable to You in any way or in relation to the contents of, or use of, or otherwise in connection with the Platform. You acknowledge, by Your use of this Platform, that Your use of this Platform is at Your sole risk; that You assume full responsibility for all risks associated in connection with Your use of this Platform.

d. Though HERO shall make all endeavour to protect its Platform from any viruses, unauthorized access, modification, deletion, unplanned downtimes, cyberattacks or other illegal use of its Platform, however We do not warrant that this site; information, content, materials, product (including software) or services included on or otherwise made available to You through the Platform; its servers; or electronic communication sent from Us are free of viruses or other harmful components. Nothing on Platform constitutes or is meant to constitute, advice of any kind.

e. HERO will not be liable for any damages of any kind arising from the use of the Platform, or from any information, content, materials, products (including software) or from failure of performance, error, omission, inaccuracy, interruption, deletion, defect or delay in operation or transmission, computer virus, communication line failure, theft or destruction or unauthorized access, or alteration, included on or otherwise made available to You through the Platform, including, but not limited to direct, indirect, incidental, punitive, and consequential damages, unless otherwise specified in writing. You specifically acknowledge that HERO is not liable for the defamatory or offensive or illegal conduct of other users or third parties and that the risk of injury from the foregoing rests entirely with You.

10. INDEMNITY

a. You shall indemnify and hold harmless HERO, its management, licensee, affiliates, subsidiaries, group companies (as applicable) and their respective officers, directors, agents, and employees, from any claim or demand, or actions including reasonable attorneys’ fees, made by any third party or penalty imposed due to or arising out of Your breach of this Terms of Use, Privacy Policy and other Policies, or Your violation of any law, rules or regulations or the rights (including infringement of intellectual property rights) of a third party.

b. You hereby expressly release HERO and/or its management, affiliates and/or any of its officers and representatives from any cost, damage, liability or other consequence of any of the actions/inactions of the vendors and specifically waiver any claims or demands that You may have in this behalf under any statute, contract or otherwise.

11. BREACH

a. In the event You are found to be in breach of the Terms of Use or Privacy Policy or other rules and policies or if We are unable to verify or authenticate any information You provide or if it is believed that Your actions may cause legal liability for You, other users or Us, without limiting to the present, without prior notice, immediately limit Your activity, remove Your information, temporarily/indefinitely suspend or terminate or block Your login, and/or refuse to provide You with access to this Platform. Any user that has been suspended or blocked may not register or attempt to register with Us or use the Platform in any manner whatsoever until such time that such user is reinstated by Us.

b. Notwithstanding the foregoing, if You breach the Terms of Use or Privacy Policy or other rules and policies, We reserve the right to take strict legal action including but not limited to a referral to the police or other authorities for initiating criminal or other proceedings against You.

c. Any breach of applicable laws shall also result in, without prior notice, immediately limit Your activity, remove Your information, temporarily/indefinitely suspend or terminate or block Your login, and/or refuse to provide You with access to this Platform.

12. LIMITATION OF LIABILITY

IN NO EVENT SHALL HERO BE LIABLE FOR ANY SPECIAL, INCIDENTAL, INDIRECT OR CONSEQUENTIAL DAMAGES OF ANY KIND IN CONNECTION WITH USE OF THE PLATFORM, THESE TERMS OF USE, AND OTHER POLICY ASSOCIATED WITH IT.

13. COMPLIANCE WITH LAWS

The Platform User shall comply with all the applicable laws, rules, notifications as issued from time to time by appropriate authorities.

14. SEVERABILITY

We reserve the right to make changes to Our Platform, policies, and these Terms of Use at any time. If any of these terms shall be deemed invalid, void, or for any reason unenforceable, that condition shall be deemed severable and shall not affect the validity and enforceability of remaining terms.

15. WAIVER

The failure by HERO to enforce at any time or for any period any one or more of the terms or conditions of the Agreement shall not be a waiver by HERO of them or of the right any time subsequent to enforce all Terms and Conditions of this Agreement.

16. SURVIVAL

Notwithstanding anything contained under these Terms, any section of these Terms of Service that by its nature is intended to survive termination of these Terms of Service or Your use or access to Our services offered on the Platform shall survive such termination.

17. DISPUTE RESOLUTION

This Agreement along with Privacy Policy and Disclaimer shall be construed and the legal relations between You and HERO hereto shall be determined and governed according to the laws of India and all disputes relating to this Agreement shall be subject to the exclusive jurisdiction of the Courts of New Delhi.

18. GRIEVANCE

For any grievances that You may have in relation to the use of the Platform (other than those relating to Platform Services), You may contact the Grievance officer. For any complaints/ issues relating to the Platform Services, You may the contact Nodal officer. The Grievance officer and Nodal officer shall thereafter consider the same and provide a response within a reasonable time.

Grievance Officer

C/o Hero MotoCorp Limited,

The Grand Plaza, Plot No.2,

Nelson Mandela Road,

Vasant Kunj - Phase -II,

New Delhi - 110070

Phone: 011-46044100

Time: 10AM – 5PM

Email: grievanceofficer@heromotocorp.com

Nodal Officer

Nilesh Borade

C/o Hero MotoCorp Limited,

Hero MotoCorp Limited Commercial Space No. 2A-2B-1801

18th Floor Two Horizon Centre,

DLF City Ph-5

Gurgaon -122002 HR, India

Phone: +91-11-46044200

Time: 10AM – 5PM

Email: customercare@heromotocorp.com

PART B - TERMS AND CONDITIONS FOR PLATFORM SERVICES

For the convenience of the customers who desire to avail/apply for loan/ credit facilities for purchase of a vehicle from HERO, the Platform provides User(s) access to information about potential loans/financing options which may be available to such Users if they purchase the relevant vehicle, and the ability to select and apply for a loan with the identified Financiers as the User/customer may deem fit (“Platform Service(s)”). “Financier” for the purposes of these Terms shall mean “a bank or financial institution offering loan to a customer for purchase of a vehicle and which financing institution has suitable onboarding agreement with HERO.

The above said Platform Services and ancillary services are provided on a commercially reasonable effort basis and You agree that Your participation for availing the above-mentioned services is purely at Your will and consent. This Part B shall apply, along with Part A of the Terms, to all persons who avail or seek to avail the Platform Services.

1. For availing the Platform Services, You/ User shall be required to fill-in details such as, name, gender, date of birth, pincode, marital status, employment status, residential status, details of existing loans, income proof and bank accounts. The information provided by You can be utilised for the below mentioned purposes:

a. To generate/refine offers for loans as accessible on the Platform;

b. To provide customized recommendations and personalized offers of the products and services of HERO and/or its business partners/affiliates;

c. To send information/personalized offers via email, text, call or online display or other means of delivery in HERO’s reasonable sole discretion;

d. To provide the information to the Financiers to enable Financiers to assess Your loan request and offer their loan facility to You on the Platform;

e. For marketing survey, customer research, feedback and internal administrative purposes subject to applicable laws;

f. To satisfy legal and regulatory obligations;

g. Any other related services.

2. By submitting, transmitting or sharing of information for the Platform Service, You expressly consent to HERO for collection and access and further processing by HERO of any personal information or other data for or towards performance of or access to the Platform Service or for authentication, verification etc. You further consent to HERO sharing with the Financier(s) to enable the Financier(s) to use, disclose, store and process such information and any data provided by or collected from You. You further acknowledge and agree that the Financiers may share Your information with credit bureaus/agencies, generate a credit score, perform a credit scrub/ credit bureau check, map Your information with its database etc. in order to check Your eligibility for a loan offer with the respective Financiers.

3. Subject to applicable laws, by submitting, transmitting or sharing of information for the Platform Service, You also expressly consent to HERO to retain, preserve, store, use and/or erase the information, as necessary including for any regulatory/ legal/ evidentiary purposes.

4. You agree and undertake that such consent or subsequent withdrawal thereof by You, shall in no way limit or affect the rights of the Financier(s) which the Financier(s) may separately have against You or such data or information whether through or pursuant to Financier’s relationship or otherwise including the customer and account based relationships of the Financier(s).

5. Your interaction with any third party such as Financier(s) is at Your own risk, and HERO will have no liability with respect to the acts, omissions, errors, representations, warranties, breaches or negligence of any such third parties or for any personal injuries, death, property damage, or other damages or expenses resulting from Your interactions with the third parties.

6. The information provided on the Platform, (including by way of the calculator, estimated equated monthly instalments (“EMI”), fees for availing a loan, etc.) is only indicative in nature and HERO disclaims any warranties explicit or implied on the accuracy, correctness or the relevance of the information. The loan offer details on the Platform may differ based on the prevailing policies of the respective Financier(s).

7. The sanction letter issued by the Financier(s) through the Platform is a provisional/conditional sanction letter issued by the Financier(s) to You sanctioning the grant of the loan facility subject to the terms and conditions contained therein. The sanction letter will also provide a validity period therein by the concerned Financier(s) after which the same shall stand expired. Upon issuance of the sanction letter, You may download the same from the Platform and submit the same to the Financier’s personnel at the concerned dealer’s location for further steps to avail the loan facility.

8. The final loan amount, EMI, processing fees, etc. will be provided to You by the Financier(s) and set out in the final sanction letter/loan documents which will be issued to You by the relevant Financier(s) subject to successful completion of verification and processing of the loan application by the Financier(s) to its satisfaction as per its prevailing policies. Any additional charges as may be levied by the respective Financiers shall also be applicable. You agree and acknowledge that the eligibility, loan amount, disbursement terms, etc. shall be at the sole discretion of Financier(s). While making any loan application through the Platform; HERO shall not be held liable for any delay, rejection or approval of any such application made through its Platform and HERO shall not be required to provide any reason whatsoever for such acceptance or rejection of Your loan application.

9. You acknowledge and agree that in relation to the Platform Services, HERO is a mere facilitator/intermediary which is providing You possible loan options to enable You to select and avail a loan from the Financier chosen by You. The information displayed on the Platform with respect to any loan or Financier(s) is as provided by the Financiers and HERO has not independently verified such information. HERO makes no representations or warranties with respect to such information and Users are advised to undertake their own due diligence before availing a loan. Users can book HERO products without availing the Platform Services and nothing herein shall constitute as HERO promoting or marketing any financial product.

10. If You choose to apply for the loan to the Financier(s), then their use of Your information is governed by their terms of use and privacy policies and HERO shall not be responsible for the use of such information by the Financiers. In addition to the above Terms, You shall be bound by the terms of use, privacy policy, and other policies issued and amended from time to time by the Financiers whose information may be accessed on the Platform. The link to the Financier’s platform for accessing the details (including aggregate fee for granting loan with compulsory and voluntary charges, name, contract number and designation of each Financier’s grievance officer) and their respective policies is as below:

Financiers | Terms Of Use | Grievance Office |

Hero FinCorp | https://www.herofincorp.com/twl-lead-form/img/termsandconditions.pdf | |

IDFC First | https://www.idfcfirstbank.com/content/dam/idfcfirstbank/pdf/Terms-and-Conditions.pdf |

|

Axis Bank | nodal.officer@axisbank.com Call : 91-080-61865200 | |

ICICI Bank |

| |

Indusind Bank | https://www.indusind.com/in/en/personal/loans/vehicle-loan/two-wheeler.html |

|

Hinduja Leyland Finance | https://www.hindujaleylandfinance.com/documents/dataprivacypolicy/Terms%20and%20conditions2024.pdf |

|

| Cholamandalam Investment & Finance Company | https://files.cholamandalam.com/files/general-declaration-for-loan-application.pdf | |

| L&T Finance | https://www.ltfs.com/faqs#twowheelerfinance | https://www.ltfs.com/grievance-redressal |

| Shriram Finance | https://www.shriramfinance.in/lending-service-provider | Mr. Sameer Suman Digital Grievance Redressal Officer Shriram Finance Limited 6th floor, Level 2, Building No. Q2 Auram Q Parc, Gen 4/1, TTC Thane Belapur Road, Ghansoli Navi Mumbai 400 710 Telephone: 022-40957575 Toll Free Number: 1800 103 6369 Email: grievance@shriramfinance.in Website: www.shriramfinance.in |

| HDFC Bank | https://www.hdfcbank.com/personal/useful-links/important-messages/product-features-and-policy | Mr. Kannan Ramaseshan (Grievance Redressal Officer) Grievance Redressal Cell, HDFC Bank Limited, 1st Floor, Empire Plaza - 1, Lal Bahadur Shastri Marg, Chandan Nagar, Vikroli West, Mumbai – 400083 Call: 1800 266 4060 Monday to Saturday 9:30am to 5:30pm |

| Muthoot Capital Services Limited | https://www.muthootcap.com/two-wheeler-loan/ | The Grievance Redressal Officer, Muthoot Capital Services Ltd, Third Floor, Muthoot Towers, M.G.Road, Kochi-682035, Kerala, India. Contact Number :0484-7119400/0484-6613450 Monday to Friday except National Holidays 10:00am to 5:00pm E-mail ID: grievance@muthootcap.com |

| HDB Financial Services | https://www.hdbfs.com/customer-services/customer-support | E-mail ID: customer.support@hdbfs.com |

| Berar Finance Limited | https://www.berarfinance.com/terms-condition.html | Berar Finance Limited Avinisha Tower, Mehadia Chowk, Dhantoli, Nagpur - 440012 Telephone: 0712-666 3999 (Extn No: 207) Email: gro@berarfinance.com |

Tata Capital | https://www.tatacapital.com/contact-us/customer-grievances.html | |

Manba Finance | https://www.manbafinance.com/two-wheeler-loan/ | Telephone: 022-62346666 |

By applying for a loan from the Financier(s), You are deemed to have read, understood and accepted the terms and conditions as applicable to the loans offered by the relevant Financiers selected by You.

Request to discontinue use of Your information: If You wish for HERO to discontinue use of any personal or financial information provided by You for the purposes of availing Platform Services, please send an email request to Us at grievance.finance@heromotocorp.com or deletion of Your information. On receiving Your request for deletion, We will erase Your data, and We will not send You any further communications in this context. You understand that by requesting to delete Your information pertaining to Platform Services We will only delete such information as provided by You for availing these Services and You acknowledge that this may adversely impact Our ability to provide the Platform Services to You. The other opted products and services, shall continue to be valid, subject to the terms specified under the above Terms of Use. Notwithstanding the forgoing, nothing herein shall prevent HERO from retaining/using:

a. Data shared by You in an aggregated and anonymised manner for data reporting, analytics, etc.;

b. Information as necessary to comply with Our legal obligations, resolve disputes and enforce Our agreements entered into for providing the relevant services and related matters.; and

c. Information provided for services other than Platform Services, in a manner required by the Terms of Use applicable to such information;

11. Disclaimer of Warranties:

a. The Platform may show ratings of the respective Financier(s) which are generated on the basis of the customer feedback received on the Platform in relation to the loan products of the Financier(s). HERO does not warrant the completeness, truthfulness and accuracy of these ratings and You shall have no claim against HERO for any decision You may take in relation to a loan product of any Financier(s) based on these ratings.

12. By providing information on the Platform for availing the Platform Services, You agree and certify that You are only availing the Platform Services for Yourself and not for and/or behalf of any other person.

13. HERO reserves the right to refuse provision of Service in its sole discretion. Notwithstanding the above, We retain the right at Our sole discretion to deny access to anyone to the Platform, the Platform Service We offer, at any time and for any reason, including, but not limited to, for violation of the Terms of Use or the Privacy Policy including additional standard terms and conditions of the CICs. Upon termination, Your right and license to access and/or use the Platform Service, immediately ceases and You will no longer be able to access or use the Platform Service.

14. For avoidance of doubt, it is clarified that provisions in relations to warranties & liabilities, indemnity, breach, limitation of liability, compliance with laws, severability, waiver and dispute resolution noted in Part A shall mutadis mutandis apply to this Part B, as relevant to the Services.

15. The Terms of Use as set out herein shall equally apply to any information provided by the User, either directly or indirectly, through any authorised dealer to HERO for availing the Platform Services via HERO’s mobile based application platform used by HERO/its authorised dealer. You authorize the relevant authorised dealer of HERO (to whom You are providing information) to provide/ fill information on the Application on Your behalf and consent to such information being used in the manner set out in these Terms and Conditions read with the Privacy Policy and Disclaimers. You shall ensure that such details shall be true, correct, accurate and shall be verified by You. HERO shall not be responsible/ liable in case the details provided by You are incorrect or inaccurate, or if the authorised dealer misuses or misappropriates Your information.

16. By clicking on the Accept button below, You state that You have read and understood the above-mentioned Terms of Use and agree to the same:

Privacy Policy - January 17, 2024

Hero MotoCorp Ltd. together with its affiliates and subsidiaries (collectively referred to as the "Company" or "Hero" or "Us" and also indicated by "us", "we" or "our") is committed to protecting your privacy and Personal Information (defined below) You give to us. We encourage You to read the Privacy Policy ("Policy").

This Policy applies to all visitors, users and others (hereinafter referred to as "You" or “Your” or the "User") who access or use the

(i) Website- https://www.heromotocorp.com;

(ii) any other websites;

(iii) mobile applications (Apps) owned and / or operated by Hero on which this Policy is linked; and

(iv) the social media accounts and/or pages that Hero controls

(together referred as “Sites/Apps”).

Except as otherwise provided in this Policy, in general, You can visit/use our Sites/Apps without identifying who You are. Hero will provide You with the option to deal with Hero without identifying yourself where it is lawful and practical. However, particular sections on our Sites/Apps may require You to provide Personal Information in order that we may provide the products/services or information You have requested while visiting/using our Sites/Apps.

This Policy is intended to let You know what Personal Information we collect, why we collect (‘purpose’) and what we do with it (‘use’), processing/sharing and transfer of Personal Information and Your rights relating to such Personal Information shared with us. By using the Sites/Apps, You agree, understand and consent to this Policy and any future amendments and additions. This Policy also describes Your personal data protection rights, including a right to object to some of the processing of Personal Information that the Company carries out.

“Personal Information” means any information that may be used to identify an individual. This includes but is not limited to: first and last name, email address, mailing and residential address, telephone number, title, birth date, gender, occupation, Your profession and other information needed to provide a service You have requested.

“![]() Sensitive Personal Data or Information” means such personal information: (i) which consists of information relating to password; financial information such as bank account or credit card or debit card or other payment instrument details; physical, physiological and mental health condition; sexual orientation; medical records and history; biometric information; any detail relating to the afore-mentioned information as provided to the Company for providing service; and any of the information received under the afore-mentioned heads by the Company for processing, stored or processed under lawful contract or otherwise (provided that, any information that is freely available or accessible in public domain or furnished under the Right to Information Act, 2005 or any other law for the time being in force shall not be regarded as sensitive personal data or information); and (ii) which reveals racial or ethnic origin, political opinions, religious or philosophical beliefs, or trade union membership, and the processing of genetic data, biometric data for the purpose of uniquely identifying a natural person, data concerning health or data concerning a natural person’s sex life.

Sensitive Personal Data or Information” means such personal information: (i) which consists of information relating to password; financial information such as bank account or credit card or debit card or other payment instrument details; physical, physiological and mental health condition; sexual orientation; medical records and history; biometric information; any detail relating to the afore-mentioned information as provided to the Company for providing service; and any of the information received under the afore-mentioned heads by the Company for processing, stored or processed under lawful contract or otherwise (provided that, any information that is freely available or accessible in public domain or furnished under the Right to Information Act, 2005 or any other law for the time being in force shall not be regarded as sensitive personal data or information); and (ii) which reveals racial or ethnic origin, political opinions, religious or philosophical beliefs, or trade union membership, and the processing of genetic data, biometric data for the purpose of uniquely identifying a natural person, data concerning health or data concerning a natural person’s sex life.

WHAT PERSONAL INFORMATION WE COLLECT?

Personal Information:

· Information You give us:

We may collect any Personal Information shared by You on our Sites/Apps. Depending upon the Sites/Apps and context, this information may include the following:

- Details of how You used our Sites/Apps;

- Internet protocol address;

- Device event information such as caches, system activity, hardware settings, browser type, browser language, the date and time of Your visit, time spent on those pages and other statistics and referral URL;

- Cookies, web beacons and other similar technologies that may uniquely identify Your browser or Your account. You can instruct Your browser to refuse all cookies or to indicate when a cookie is being sent. However, if You do not accept cookies, You may not be able to use some portions of our Sites/Apps.

· Information collected automatically:

Log information:

Depending upon the Sites/Apps or context, we automatically collect and store certain information that Your browser sends whenever You visit our Sites/Apps in server logs (Log Data). This includes:

- Details of how You used our Sites/Apps;

- Internet protocol address;

- Device event information such as caches, system activity, hardware settings, browser type, browser language, the date and time of Your visit, time spent on those pages and other statistics and referral URL;

- Cookies, web beacons and other similar technologies that may uniquely identify Your browser or Your Account. You can instruct Your browser to refuse all cookies or to indicate when a cookie is being sent. However, if You do not accept cookies, You may not be able to use some portions of our Sites/Apps.

· Cookies, Web Beacons and Tracking Codes:

Cookies are small text files that a website downloads onto Your computer or other internet-enabled devices (such as mobile phones and tablets) when You visit a website. The cookie will help the website recognise Your device the next time You visit.

We may use both session cookies (disappear after You close Your browser) and persistent cookies (remain after You close Your browser and may be accessed every time You use or connect to our Sites/Apps). We may collect information like User’s IP address, geographical location, browser/device type and version, operating system, referral source, device, length of visit, page views and website navigation paths, as well as information about the timing, frequency and pattern of User’s website use through ‘cookies’.

You can block cookies by activating the setting on Your browser that allow You to refuse the setting of all or some cookies. However, if You use Your browser settings to block all cookies (including essential cookies), You may not be able to access all or parts of our Sites/Apps, or they may not function properly.

For more information about our use of cookies please refer to our “Cookie Policy” - https://www.heromotocorp.com/en-in/cookie-policy.html

· Social Media Widgets:

Our Sites/Apps may include social media features connected with social media platform such as Facebook, Twitter, Instagram, Snapchat, Google Plus, Pinterest, YouTube and others. These features may collect information about Your IP address and which page You are visiting or features You are using, and may set a cookie or employ other tracking technologies. Social media features and widgets are either hosted by a third party or hosted directly on our Sites/Apps. Your interactions with those features are governed by the privacy policies of the companies that provide them.

Tracking code in website analytics, a tracking code is a snippet of script that tracks the activity of a Sites/Apps User by collecting data and sending it to the analytics module. The code is generated automatically, is different for each website, and can be installed on each page that needs tracking.

· Careers:

Our Sites/Apps may include a link to our ‘Career Section’. Any Personal Information submitted through that portion of the Sites/Apps, by upload or via e-mail, will be governed as per this Policy.

· Platform Services:

For the convenience of the customers who desire to avail/apply for loan/ credit facilities for purchase of a vehicle from Hero, the Sites/Apps provide User(s) access to information about potential loans/financing options which may be available to such Users if they purchase the relevant vehicle, and the ability to select and apply for a loan with the identified Financiers as the User/customer may deem fit (“Platform Service(s)”). “Financier” for the purposes of this Privacy Policy shall mean a bank or financial institution offering loan to a customer on the Site/Apps for purchase of a vehicle.

For availing the Platform Services, You shall be required to fill-in details such as, name, gender, date of birth, pincode, marital status, employment status, residential status, details of existing loans, income proof and bank accounts.

Further, for availing the Platform Services, You may be required to provide Your credit score, credit information report, aggregates, variables, inferences and details (together referred to as “Credit Information”), as supplied by a credit information company as may be engaged by Hero (“CIC”).

HOW WE COLLECT THE PERSONAL INFORMATION?

Hero will generally collect Your Personal Information directly from You. This may be achieved through Your interactions with Hero including interactions via our Sites/Apps, other social media applications or internet sites, telephone, email or writing to us.

Hero may also collect Your Personal Information through its authorised dealers or from a third-party source, such as our vendors, business partners, government authorities and judicial authorities.

WHY WE COLLECT THESE PERSONAL INFORMATION?

Unless otherwise provided in the Policy, we may use Personal Information collected from the Sites /Apps in various ways including:

· To facilitate or fulfil the information, products or services You have requested;

· To contact the User for confirming Your registration on our Sites / Apps;

· To communicate with the User to respond to his/her queries or seeking feedback or resolving disputes on the product and services;

· For business, marketing and promotional purposes such as sending information about special promotions, programs, schemes, offers, new features, plans on products/services & marketing communications that we believe may be of interest to You;

· For the legitimate business interest, such as prevention of money laundering, fraud detection and prevention, and enhancing safety;

· To consider an application for career with Hero;

· To consider an application from prospective vendors for partnering with Hero;

· To educate You about us, our products and services or to understand Your interest to improvise the content and performance of our Sites/Apps;

· For maintenance of high quality and standards of products and services;

· To send You important information regarding the Sites/Apps, changes in terms and conditions, user agreements, and policies and/or other administrative information;

· For internal business operations including:

- Reviews and data analysis for the website (e.g., to determine the number, category of visitors to specific pages within the Sites/Apps);

- To manage, operate, maintain and secure our Sites/Apps, network system and other assets and to customize/personalise Your experience with us, which may include displaying content based upon Your preferences;

- For the purposes of analysing the use of the Sites/Apps, enabling and monitoring Your use of our Sites, /Apps operating our Sites/Apps, ensuring the security of our Sites/Apps, for maintaining back-ups of our databases;

- To help diagnose problems with our server, and to administer our Sites/Apps.

· To comply with our legal obligations or as otherwise permitted by law.

· To investigate potential breaches, or to protect the rights, property or safety of Hero, the Users of our Sites/Apps or others.

· For any other purpose necessary or incidental to our business.

· For any other purpose for which You give Your consent.

· To enforce our terms and conditions;

· For information provided in relation to Platform Services:

- To generate/refine offers for loans as accessible on the Sites/ Apps;

- To provide customized recommendations and personalized offers of the products and services of Hero and/or its business partners/affiliates;

- To send information/personalized offers via email, text, call or online display or other means of delivery in Hero’s reasonable sole discretion;

- To provide the information to the Financiers to enable Financiers to assess Your loan request and offer their loan facility to You on the Sites/ Apps;

- For marketing survey, customer research, feedback and internal administrative purposes subject to applicable laws;

- For compliance with legal and regulatory obligations;

- Any other related services.

· Your Credit Information is used for the following purposes (and such Credit Information will not be retained by Hero after completion of the permitted use in accordance with applicable laws):

- To present You with your Credit Information;

- To provide You with customized recommendations and personalized/ pre-approved offers of loans from Financiers which may be available if You purchase a Hero vehicle;

- To send You information / personalized offers via email, text, call or online display or other modes/channels at the sole discretion of Hero;

- To aggregate anonymous data for the purpose of data analytics and reporting s;

- To store the Credit Information in accordance with the terms of this Privacy Policy;

- To improve customer experience on the Sites/ Apps.

In the event we use Your Personal Information for other purposes, not specified above, we will inform You about the specific purposes for processing of Your Personal Information and, when required, our basis for doing so at the time we collect the Personal Information from You to the extent required by law.

For the purposes of clarity, we may also use Your Personal Information in combination with information we obtain from third parties about You for the same purposes described above.

In the event that You provide any Personal Information on any of the Sites/Apps, You consent to the transfer of such information across country borders, and to the use, processing, and disclosure of such information in global locations, including those that may have different levels of privacy protection than in Your own country.

THIRD PARTY LINKS:

Our Sites/Apps may have links to the websites/mobile applications of other third parties and these third-party websites/ mobile applications may collect Personal Information about Users for their own purpose, in such cases, our Policy does not extend to these external websites/mobile applications of third parties. Please be aware that if You access these links, You will be leaving our Sites/Apps. We encourage Users to read the privacy policies of those websites/mobile applications, as we are not responsible for their content, links, or privacy procedures.

If You choose to apply for the loan to the Financier(s), then their use of Your Personal Information is governed by their terms of use and privacy policies and Hero shall not be responsible for the use of such information by the Financiers. You shall be bound by the terms of use, privacy policy, and other policies issued and amended from time to time by the Financiers whose information may be accessed on the Site/ Apps. The link to the Financier’s platforms for accessing the details (including aggregate fee for granting loan with compulsory and voluntary charges, name, contract number and designation of each Financier’s grievance officer) and their respective policies is as below:

Financiers | Terms Of Use | Grievance Office |

Hero FinCorp | https://www.herofincorp.com/twl-lead-form/img/termsandconditions.pdf | |

IDFC First | https://www.idfcfirstbank.com/content/dam/idfcfirstbank/pdf/Terms-and-Conditions.pdf |

|

Axis Bank | nodal.officer@axisbank.com Call : 91-080-61865200 | |

ICICI Bank |

| |

Indusind Bank | https://www.indusind.com/in/en/personal/loans/vehicle-loan/two-wheeler.html |

|

Hinduja Leyland Finance | https://www.hindujaleylandfinance.com/documents/dataprivacypolicy/HLFDataPrivacyPolicy.html |

|

| Cholamandalam Investment & Finance Company | https://files.cholamandalam.com/files/general-declaration-for-loan-application.pdf | |

| L&T Finance | https://www.ltfs.com/docs/default-source/default-document-library/data-privacy-policy.pdf?sfvrsn=729aba03_3 | https://www.ltfs.com/grievance-redressal |

| Shriram Finance | https://www.shriramfinance.in/lending-service-provider | Mr. Sameer Suman Digital Grievance Redressal Officer Shriram Finance Limited 6th floor, Level 2, Building No. Q2 Auram Q Parc, Gen 4/1, TTC Thane Belapur Road, Ghansoli Navi Mumbai 400 710 Telephone: 022-40957575 Toll Free Number: 1800 103 6369 Email: grievance@shriramfinance.in Website: www.shriramfinance.in |

| HDFC Bank | https://www.hdfcbank.com/personal/useful-links/important-messages/product-features-and-policy | Mr. Kannan Ramaseshan (Grievance Redressal Officer) Grievance Redressal Cell, HDFC Bank Limited, 1st Floor, Empire Plaza - 1, Lal Bahadur Shastri Marg, Chandan Nagar, Vikroli West, Mumbai – 400083 Call: 1800 266 4060 Monday to Saturday 9:30am to 5:30pm |

| Muthoot Capital Services Limited | https://www.muthootcap.com/two-wheeler-loan/ | The Grievance Redressal Officer, Muthoot Capital Services Ltd, Third Floor, Muthoot Towers, M.G.Road, Kochi-682035, Kerala, India. Contact Number :0484-7119400/0484-6613450 Monday to Friday except National Holidays 10:00am to 5:00pm E-mail ID: grievance@muthootcap.com |

| HDB Financial Services | https://www.hdbfs.com/customer-services/customer-support | E-mail ID: customer.support@hdbfs.com |

| Berar Finance Limited | https://www.berarfinance.com/terms-condition.html | Berar Finance Limited Avinisha Tower, Mehadia Chowk, Dhantoli, Nagpur - 440012 Telephone: 0712-666 3999 (Extn No: 207) Email: gro@berarfinance.com |

Tata Capital | https://www.tatacapital.com/contact-us/customer-grievances.html | |

Manba Finance | https://www.manbafinance.com/two-wheeler-loan/ | Telephone: 022-62346666 |

By applying for a loan from the Financiers, You are deemed to have read, understood and accepted the terms and conditions as applicable to the loans offered by the relevant Financiers selected by You.

RETENTION, PROCESSING AND STORAGE OF INFORMATION:

Your Personal Information processed by Hero is kept in a form which permits Your identification for no longer than is necessary for the purposes for which the Personal Information is processed in line with legal, regulatory, contractual or statutory obligations as applicable. At the expiry of such periods, Your Personal Information will be deleted or archived to comply with legal/contractual retention obligations or in accordance with applicable statutory limitation periods, and/ or be aggregated and anonymised for data reporting, analytics, etc.

Additionally, You may also request to discontinue the use of any personal or financial information provided by You for the purposes of availing Platform Services, in a manner set out in the terms and conditions and subject to conditions set out thereunder.

WITH WHOM WE SHARE YOUR PERSONAL INFORMATION (OTHER THAN CREDIT INFORMATION)?

We may share the Personal Information (other than Credit Information) collected from the Sites/Apps with third parties as outlined in this section.

1.1. Affiliates

Our parent company, subsidiaries, joint ventures, group and associate companies. These entities may use this information for the purposes outlined above.

1.2. Business Partners

(i) Service Providers who perform services on behalf of Hero and which may need information about You in order to perform their functions including but not limited to authorised service partners, call centre operators, marketing contractors, social media website providers, data entry service providers, IT agencies operating handling or maintaining Sites/Apps, storing/processing information, overseas service providers who work for us, etc.

(ii) Vendors who are business associates of Hero like suppliers, research and development vendors, professional advisors, agents, representatives, etc.

1.3 Financier(s) and CICs

(i) Financier(s) to enable them to use, disclose, store and process such Personal Information and any data provided by or collected from You. Financiers may share Your Personal Information with credit bureaus/agencies, generate a credit score, perform a credit scrub/ credit bureau check, map Your information with its database etc. in order to check Your eligibility for a loan offer with the respective Financiers.

(ii) CICs or its affiliates, to obtain, receive and compile your Credit Information.

1.3. Other Partners

Any third party with whom Hero co-brands or partners with or collaborates with or with any other third parties as may be necessary for Hero’s business purposes or to investigate potential data incidents or to protect the rights, property and safety of Hero and the Users of our Sites/Apps or others.

1.4. Legal Authorities

We may share Your Personal Information in response to any notice, order, investigation or demand or request or any other communication from a law enforcement agency which necessitate or mandate the sharing of such Personal Information, or to otherwise comply with applicable laws.

1.5. Changes in Corporate Structure or Bankruptcy

In the event that Hero is involved in a merger, acquisition, reorganization or sale of assets, bankruptcy, Your Personal Information may be transferred as part of that transaction. We also may retain a copy of such information.

We DO NOT use or disclose Personal Information for purposes other than as mentioned in this Policy, except with the consent of User providing such Information or as required by law.

INTERNATIONAL SHARING AND / OR TRANSFERS OF YOUR PERSONAL INFORMATION

Hero is a global company and therefore uses global dealers, distributors, vendors, subcontractors and other business partners, as well as global IT systems and applications. We may require the transfer of Personal Information / Sensitive Personal Data or Information.to other third parties that are located outside of Hero’s country of business. We shall develop a standardized approach for protection of data moving across borders. We will adopt appropriate technical and administrative controls that apply well to cross border data flows to act as an accountability framework for information management as a whole and including natural checkpoints for each step of international transfer.

If You are citizen of European Union/European Economic Area (the "EU/EEA") the following terms apply to Your Personal Information: Your Personal Information may be shared with and / or transferred to our global affiliates and to our employees, contractors and business partners who work for us and are located outside the EU/EEA for the purposes described in this Policy. If this is the case, we will take legally required steps under the General Data Protection Regulation ("GDPR") to ensure that adequate safeguards are in place to protect Your Personal Information in accordance with this Policy.

ACCESS AND ACCURACY:

Hero wants to maintain only accurate information about the Users. You can request access to Your Personal Information by contacting us at:

- grievance.finance@heromotocorp.com – For Personal Information shared on the Sites/Apps for availing Platform Services;

- grievanceofficer@heromotocorp.com – For Personal Information shared on the Sites/Apps for any other purpose.

Upon receipt of appropriate identification information, and where required by applicable data protection laws, Hero will provide You with access to the information that it maintains about You.

YOUR RIGHTS:

At Hero, we take Your privacy very seriously, and we never monetize Your information; we use it to enhance Your experience. When it comes to Your privacy rights, we want to make sure You have everything You need to make informed decisions. You have the right to:

· Right of Access - You have the right to be informed why and how we collect Your Personal Information, how we will use this Personal Information, who we share it with, what are the security measures we take to protect this information and what Your individual rights are. Hero shall provide a copy of the Personal Information undergoing processing. For any further copies requested, please note that Hero may charge a reasonable fee based on administrative costs.

· Right to Rectification - You have the right for updation of any inaccurate or incomplete Personal Information we may hold.

· Right to Erasure - Except in cases where retention of Personal Information is required or permitted under any applicable law, You have the right to request that we delete any Personal Information which we are holding about You.

· Right to Restrict Processing - Except in cases where processing of Personal Information is required or permitted under any applicable law, You have the right to restrict processing or limit the usage of all or some of Your Personal Information (e.g., if we have no legal right to process it, if Your Personal Information data is inaccurate or unlawfully held).

· Right to Data Portability - You have the right to receive Your Personal Information or to transmit that information to another controller in a structured, commonly used and machine-readable format.

· Right to Object to the Processing - You have the right to object, on grounds relating to Your particular situation, at any time to processing of Personal Information concerning You. Such right can be exercised at any time where Your Personal Information is processed for direct marketing purposes.

· Right to object being subjected to a decision based solely on automated processing, including profiling.

· You may opt-out of receiving non-essential (promotional, marketing-related) communications from us & or our affiliates / business partners / other partners / third parties. If You want to opt-out from any such communication as mentioned above, You may send an email to grievance officer’s email ID (as mentioned under ‘Contact Us’ section of this Policy).

At any stage, You can withdraw Your consent to the retention/storage/processing of Your Personal Information and Hero shall erase the Personal Information withdrawn by You unless there is a contractual obligation or legal requirement/obligation to retain/hold it or otherwise permitted by law to retain it. However, upon such withdrawal, the Company will not able to communicate with You and provide You with certain information on product and/or services which are required for fulfilment of any obligation.

Subject to applicable laws Hero, may at its sole discretion, in certain cases of excessive or manifestly unfounded request, charge a fee for fulfilling your request. The relevant contact details of ‘Data Protection Officer’ are provided in this Policy.

HOW TO SUBMIT A REQUEST?

You may submit a request to exercise your rights mentioned in this Policy by following the below steps:

· Download and fill the DSR form attached below

· Submit the DSR form on the following email: –

- grievance.finance@heromotocorp.com – For Personal Information shared on the Sites/Apps for availing Platform Services;

- grievanceofficer@heromotocorp.com – For Personal Information shared on the Sites/Apps for any purpose other than the Platform Services.

HOW WE PROTECT YOUR PERSONAL INFORMATION?

Our Sites/Apps have stringent security practice and measures in place to protect the Personal Information provided to us. Our database stores Personal Information in secure environment that are designed to safeguard it from loss, misuse, wrongful disclosure, destruction and alteration. The security measures are reviewed periodically by Hero to keep pace with business, technology and regulatory changes.

· The security and confidentiality of Your Personal Information is important to us and Hero has invested significant resources to protect the safekeeping and confidentiality of Your Personal Information. When using external service providers acting as processors, we require that they adhere to the same standards as Hero. Regardless of where your Personal Information is transferred or stored, we take all steps reasonably necessary to ensure that Personal Information is kept secure.

· We have physical, electronic, and procedural safeguards that comply with the applicable laws to protect Personal Information about You. We seek to ensure compliance with the requirements of the GDPR and the regulatory requirements to ensure the protection and preservation of Your privacy.

· We take appropriate security measures to protect against unauthorized access to or unauthorized alteration, disclosure or destruction of Personal Information.

CONTACT INFORMATION:

We welcome Your questions, comments, and concerns about privacy. If You have any questions about the Policy or our data practices, please contact us as follows:

Grievance Officer

C/o Hero MotoCorp Limited,

The Grand Plaza, Plot No.2,

Nelson Mandela Road,

Vasant Kunj - Phase -II,

New Delhi - 110070

Phone: +91 11-46044100

Email: grievanceofficer@heromotocorp.com

The Grievance Officer shall expeditiously redress the grievances and within reasonable time as may be provided under applicable laws.

Please note that email communications are not always secure, so please do not include credit card information or other sensitive information in any email communication to us.

UPDATES TO THIS POLICY:

We may periodically update this Policy. Please refer the updated on legend at the top of this page to see when this Policy was last revised. Any changes to this Policy will become effective when we post the revised Policy on our Sites/Apps. Your use of the Sites/Apps following these changes shall be considered as Your acceptance of the revised Policy.

Your details will help us suggest you with the best offers